As the world gathers at COP30 in Belém, still grappling with how to bring climate adaptation to age, Bill Gates’ memo “Three Tough Truths About Climate” reframes the debate: development itself is adaptation. But if that is true, who pays for it? Across Africa, an answer is emerging. Through the Adaptation Benefits Mechanism (ABM) — a homegrown, non-market approach that turns verified resilience outcomes into measurable and fundable results — African innovators are showing that resilience can be not only built, but bankable.

The author, Luc Gnacadja, is Co-Chair of the Adaptation Benefits Mechanism Executive Committee (ABM-EC), former Minister of Environment, Housing and Urban Planning of Benin, and former Executive Secretary of the UN Convention to Combat Desertification (UNCCD).

—-o—-

At dawn in Degbadji, a coastal village south of Ouidah, the salt-harvesting women used to watch the delicate balance between the chaplet of salted lagoons, the mangroves, and their salt pans become increasingly unstable. Each year, irregular flooding and shifting water flows damaged their salt pans and eroded the mangrove fringes—mangroves they also had to cut, as wood was their only available source of energy. “The water kept changing course each season,” recalls Ms. Houessou, the women’s cooperative leader, affectionately nicknamed “the head.” “We can’t cope anymore with our meager resources.

That is about to change. Through the project Community-Based Adaptive Management of Mangroves for Climate Resilience and Sustainable Livelihoods in Benin, local cooperatives are working to preserve mangrove ecosystems that protect the coastline from sea-level rise while improving the socio-economic conditions of salt-producing women. The initiative promotes access to clean and sustainable energy and water, restoring nature even as it restores dignity.

This initiative is one of dozens of grassroots-level adaptation activities under consideration within the Adaptation Benefits Mechanism (ABM) pilot phase, which seeks to demonstrate how measurable climate-resilience outcomes can attract sustainable finance. It embodies the spirit of what the ABM stands for: turning resilience into a measurable, verifiable, and bankable result.

The Gates Provocation

In his recent memo “Three Tough Truths About Climate[1],” Bill Gates challenges the world to rethink its approach to climate change. He argues that focusing exclusively on emissions can distract from the urgent needs of billions of people on the front lines of poverty, hunger, and disease. In poor countries, he insists, “development doesn’t depend on helping people adapt to a warmer climate—development is adaptation.”

Gates is right. Yet if development is adaptation, the question remains: who pays for it?

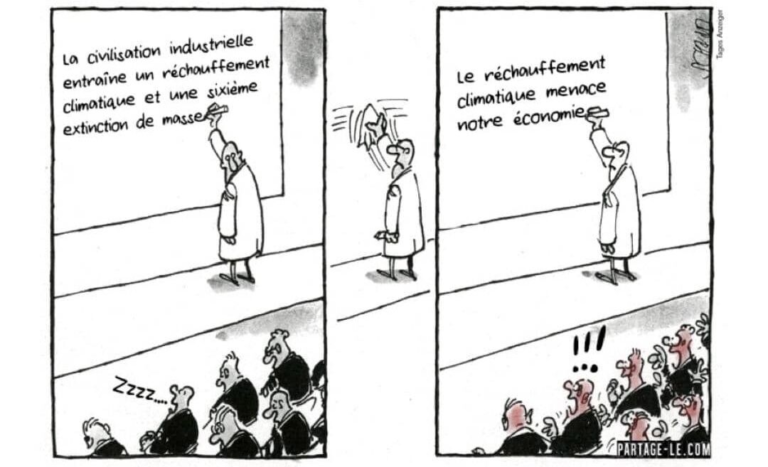

According to the Climate Policy Initiative (2025), adaptation and dual-benefit finance together account for barely 8 % of global climate-finance flows—less than five percent for dedicated adaptation, compared to nearly two trillion dollars for mitigation. The imbalance is staggering: we spend massively to slow warming, but invest little to help communities live with it.

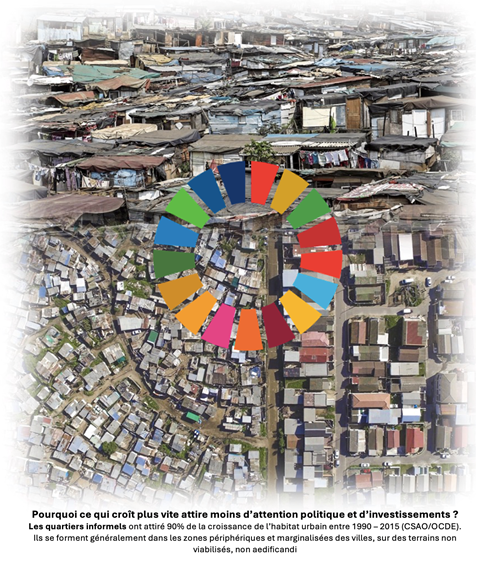

Nowhere is this contradiction clearer than in Africa, where floods, droughts, and heatwaves are daily realities, not future risks. Urban and rural communities alike are striving to build resilience amid chronic underinvestment. The problem is not the lack of solutions but the absence of financial architecture capable of recognizing and rewarding adaptation outcomes.

A Fourth Truth from Africa: Resilience Can Be Measured and Financed

Bill Gates identified three truths about climate. A fourth one is now emerging from Africa: resilience is measurable and bankable—if we value it correctly.

The Adaptation Benefits Mechanism embodies this principle. Conceived by the African Development Bank (AfDB) and recognized earlier this year by the United Nations as the first operational non-market approach (NMA) under Article 6.8 of the Paris Agreement, the ABM turns the moral imperative of adaptation into an investable opportunity for shared resilience.

Its logic is simple yet transformative. Projects that reduce climate vulnerability—such as restoring mangroves, promoting climate-smart agriculture, or strengthening flood defences—generate Certified Adaptation Benefits (CABs) once their results are independently verified. Donors, governments, or companies can then purchase these CABs not to offset emissions but to contribute transparently to the cost of adaptation. Every dollar goes directly toward strengthening communities and ecosystems.

Unlike carbon markets, ABM is a non-market mechanism. There is no speculation or trading for profit. The price of a CAB is determined not by supply and demand but by the financing gap a project must close to achieve its adaptation outcomes. The value of a CAB lies in lives and livelihoods protected—not tonnes of carbon avoided.

From Moral Imperative to Investment Proposition

Two complementary financing modalities make ABM work.

- The ex-ante modality allows a project to raise capital before implementation. Buyers commit to purchase future CABs, giving developers a guarantee that unlocks loans or blended finance.

- The ex-post modality rewards projects that have already delivered results, enabling them to scale or sustain activities after donor support ends.

Together, these pathways transform adaptation from a one-off grant activity into a self-sustaining investment cycle.

Across Africa, the pilot phase (2019–2025) has proved the concept. In Côte d’Ivoire, smallholder cocoa farmers are adopting climate-resilient agroforestry systems that stabilize yields under rising temperatures. In Kenya and Nigeria, mobile flood-barrier technologies are protecting markets and informal settlements from seasonal flooding. In Benin, mangrove restoration will revive an entire coastal economy.

Each initiative generates CABs—tangible, measurable units of resilience. Each demonstrates that the world’s most vulnerable communities can be partners in innovation, not merely recipients of aid.

Why the World Needs a Non-Market Mechanism

The climate-finance system remains skewed toward markets that reward emission reductions. Yet markets cannot price avoided losses or measure the worth of a restored ecosystem. Adaptation has no natural market—only a shared human interest.

That is why a non-market mechanism like ABM matters. It establishes a transparent, equitable framework where adaptation results are verified and rewarded as global public goods. It aligns perfectly with the equity principles of the Paris Agreement and the Global Goal on Adaptation. It also provides donors and corporations with a credible instrument to make non-offsetting contributions to resilience—something Gates himself calls for when he emphasizes welfare-first interventions.

By integrating CABs into national adaptation plans and budget frameworks, countries can attract predictable finance while maintaining ownership of their climate priorities.

From Pilot to Global Mechanism

At COP 30 in Belém, the ABM will mark a historic moment: the issuance of the first Certified Adaptation Benefits. This milestone confirms that adaptation outcomes can be quantified, verified, and financed with integrity. The next phase (2026–2030) aims to scale the mechanism globally, supported by a multi-partner platform engaging governments, development banks, private investors, and philanthropies.

Imagine if emitters responsible for just 25 % of global greenhouse-gas emissions contributed USD 10 per tonne toward purchasing CABs. That would mobilize nearly USD 100 billion a year—roughly one-third of the Baku-to-Belém target for adaptation finance.

The message is clear: the world cannot close the adaptation gap with grants alone. It needs new sources of funding, guided by transparency, fairness, and shared accountability.

A Call from Belém

By turning resilience into measurable, verifiable outcomes, ABM gives value to what was once intangible. By anchoring adaptation in human welfare, it rebuilds trust — between North and South, between corporations and communities. By financing protection rather than profit, it redefines what “investment” means in an age of climate disruption.

As the salt harvesters of Degbadji remind us, planting mangroves is not charity — it is development as adaptation, and proof that Africa’s ingenuity can illuminate a fairer, safer climate future.

The world has invested billions to slow warming; it must now invest wisely to live with it. Will leaders — including Bill Gates himself — now champion innovations like the Adaptation Benefits Mechanism, which turn that conviction into action?

[1] https://www.gatesnotes.com/three-tough-truths-about-climate

Also available as a PDF. Click here to download